|

FAQs |

How good is this, really?

We characterize backtesting statistical performance in terms of the fraction of the number of winning trades divided by the total number of trades (% Winning Trades) and the fraction of the gross dollar gains divided by gross dollar losses (Profit Factor).

Imagine tossing a coin where the probability of heads is equal to the '% of Winning Trades' and the cumulative winnings on heads divided by cumulative losses on tails is the 'Profit Factor'.

The following performance factors are computed based on a 12 month trading period using each symbol in the S&P500 using the position size and, unless noted below, portfolio management strategy described in Help.

You can view the raw backtesting data for the performance metrics by selecting the period ending date.

Period Ending Profit Factor Winning Trades Aug 12, 2016 5.7 75% Oct 14, 2017 5.9 69%

Backtesting Notes:

- Sufficient capital is available for holding concurrent trading positions.

- Stocks are bought and sold at the next day opening price upon a buy or sell signal. No Buy-Stop Limits or stop losses are used.

- A zero net gain is counted as a win, although this is rare.

- The impact of any commission fees has a small negative impact on the profit factor.

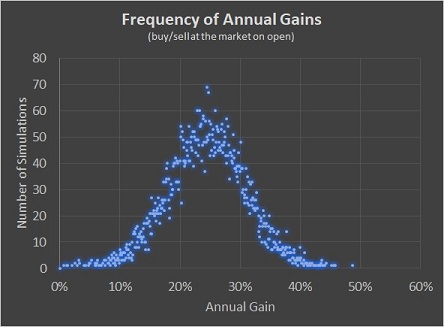

- As in many real-world forecasting scenarios, future stock prices are not known yet traders value predictable performance in their trading accounts. If we assume the above 12 month performance metrics hold in the future we can use a Monte Carlo trading simulation to determine the expected range of future portfolio gains. If we blindly buy and sell upon a signal at the next open with no Buy-Stops or limits we would expect, on average, an annual gain of 25%. (see below)

CFTC RULE 4.41 - These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

CFTC RULE 4.41 - These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

DISCLAIMER: The content provided on this website is for informational and educational purposes only and is not intended as financial advice. We recommend consulting with a qualified financial advisor to tailor advice specific to your financial situation.When do I sell?

Swing trades are designed to last typically from 2 to 20 trading days. Unlike Buy and Hold strategies you only keep your money working when there is price movement. Assume that some of your capital will NOT always be in play. Therefore, we strive for daily gains in excess of 0.5%, as a gain of 0.5% per day will double your portfolio's value in one year. Sell all or part of your position once you make 3% or more. If the price is still trending after 3% tighten your sell stop-loss order. Always keep a sell-stop order to protect your initial capital. Remember that market conditions such as opening price gaps and 'flash crash' events can prevent a sell-stop or stop-limit order from executing. However, the fixed price of sell-stop orders may reduce the risk of selling your stock in the trough of a sudden market dip or flash crash.

What if the buy order is not executed on the day of the order?

The trade signal will usually disappear within one trading day. If the signal does disappear the thesis of imminent price movement has weakened. Any opened buy orders should be carefully monitored as new momentum may be delayed several days. Cancel the order if unfilled after 5 days or more.

What to do with a sell tip?

To keep things simple Stocksaurus is reporting 'Long' Trade Signals. A Sell Stop price is computed when the data shows a pattern that historically leads to a downward trend. Use this price in a 'Stop-Limit' order to protect your positions if you are 'long' (holding) the stock. You may use the same price as a 'Sell Short' price if you are inclined to short stocks. The trade signal will usually disappear within one trading day. If the signal does disappear the thesis of imminent price movement has weakened. Any opened sell stop orders may remain to protect gains. If the stock price allows, you should continue to move the sell stop price higher or use a trailing stop loss order to protect your position.

Why do some signals seem contrary to what the chart shows?

Stocksaurus may find that an artificial intelligence-based strategy produces the best results on backtesting as opposed to using technically based signals. You may even see a buy signal in a strong downtrend. In this case the signal is based on learning an association of a near term price reversal with a complex data pattern that may not be readily apparent in reviewing standard charts and technical metrics.

Why can't I add my own stocks?

Stocksaurus relies on stocks in the S&P500 with a price history of 18 months or more. The S&P500 naturally evolves, removing underperformers and adding rising stars. This ensures that fundamentals and trading volumes are adequate to minimize the risk of significant price gaps at market open. This risk is often due to low-volume stocks or highly inefficient pricing patterns that occur more frequently with smaller companies.

Why is the service cost so low?

Stocksaurus uses cloud computing. The computers are well kept in a comfortable environment with clean stable power. They live happy and healthy lives and don't ask for much in return so our operating costs are relatively low. This allows us to price Stocksaurus to provide exceptional value even when compared to services costing ten (10) times as much.

What is going on behind the scenes to create these watchlists?

Stocksaurus uses signal processing and machine learning along with technical trading know-how to uncover signals for directional trends over a 2-10 day timeframe. Here is our back-end at work: Click here